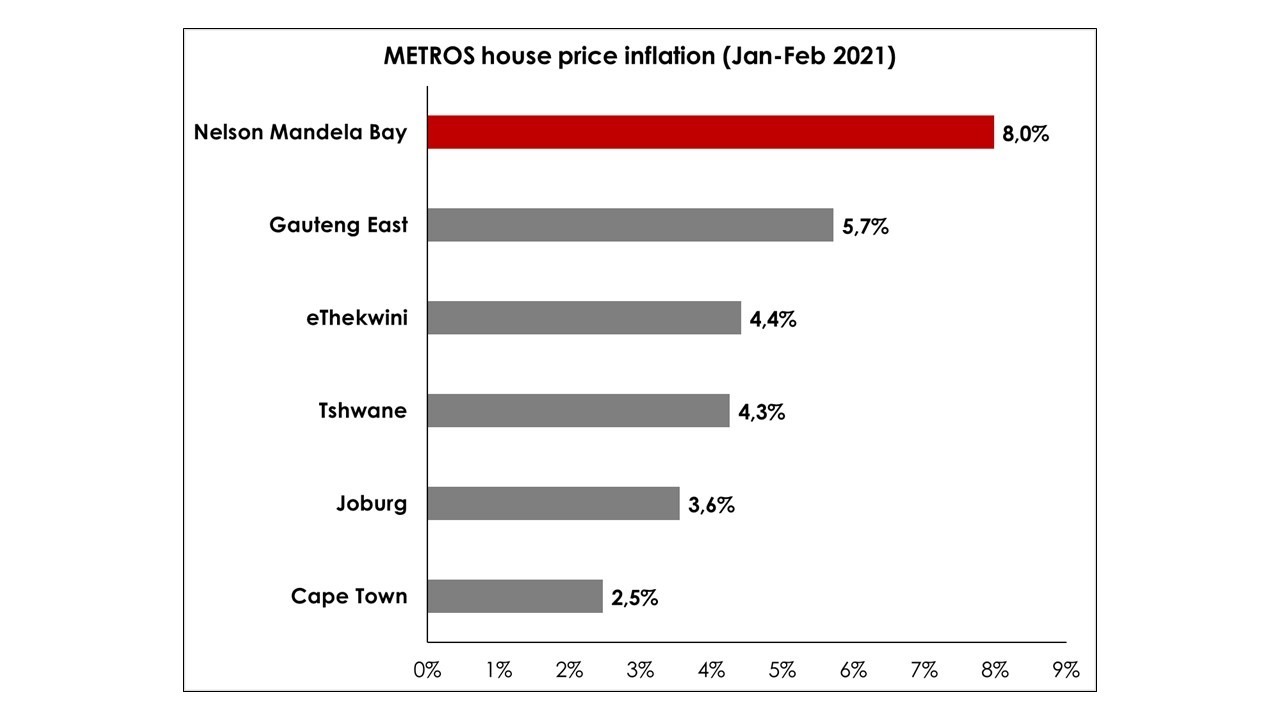

By late-2020, activity in the residential property market in Nelson Mandela Bay Metropole had rebounded to around pre-Covid levels. According to Lightstone, strong house price inflation of 8% for January to February 2021 (latest available data) sees this city retain its place as the top performing metro housing market in South Africa. This even surpasses Gauteng East’s solid house price growth rate of 5.7% over the same period (graph attached).

Sandra Gordon, Pam Golding Properties senior research analyst says: “Since December 2019 NMB has outperformed relative to other metro housing markets. House prices in NMB rose by an average of 6.29% last year (2020), which is almost double the increase in eThekwini (at 3.26%) – the second strongest growth rate recorded last year, with robust growth in NMB house prices continuing into the new year.”

Says Justin Kreusch, Pam Golding Properties area principal in Gqeberha: “Notwithstanding the lockdown – including the initial hard lockdown – for the 12-month period from March 2020 to the end of February 2021, we’ve had our best financial year to date both in terms of sales turnover and volumes, namely units sold. This is despite the fact that due to the Covid-19 regulations we couldn’t trade during the latter part of March, April and May last year (2020).

“Some notable sales include a Summerstrand property that sold for R6 million cash prior to going to market, another Summerstrand home which fetched R10 million, and a home in Little Walmer Golf Estate which sold for R6.75 million. There has also been significant activity in the Beachview/Seaview area which is underpinned by a trend towards residing slightly further out of town, especially since it’s generally now widely accepted to work from home.

“That said, while we are active in the top end of the market, above R3 million, 86% of our sales are in the sub-R3 million price band.”

While residential property in NMB remains predominantly freehold, comprising 73.5% of total units, the composition of housing stock is experiencing a shift towards sectional title property and, to a lesser extent, estate homes, which comprise approximately 5.6% of the total. (The breakdown of home types within an estate is not available.)

To cater for the demand for affordably priced family homes ideal for work-from-home, a brand-new development, Mill Park Private Estate, conveniently situated in easy reach of Greenacres Mall, Greenacres Hospital, Collegiate Schools and Grey High School, has been launched. Says Kreusch: “Forty-five spacious, three and four-bedroom homes with open plan interiors and priced from R3.05 million offer the ideal option to work from home while children have their own space for homeschool or outside recreation – all in a secure environment and in close proximity to all amenities, including the Golf Club. To view visit: https://www.pamgolding.co.za/property-development/gqeberha-port-elizabeth/mill-park-private-estate

Adds Kreusch: “Over the past 12 months we’ve also seen an influx into the area of younger buyers, including young families and professionals, contributing to the fact that the majority of recent buyers were middle-aged or young adults.

“Areas which are most sought after among home buyers include Summerstrand, Walmer and Mill Park. On the other side of Cape Road, Mount Croix and Glendinningvale also remain popular as they offer similar convenience in terms of location, but in a more affordable price range.

“In the Western Suburbs, which offer easy access to the N2 and are in close proximity to Baywest Mall, the area of Lorraine, with homes priced up to about R1.65 million, is in demand among home buyers, with numerous businesses migrating here. A few years ago, Toyota relocated their main branch to Lorraine, with an investment of over R20 million, while Makro, which is already situated in the Western Suburbs, recently relocated their store further west to Bridgemead.”

Kreusch says all these areas are sought after due to their easy access to good schools and work precincts and, in the case of Summerstrand, proximity to the beachfront. For more accessibly priced areas it’s more about great value while not being too far from schools and shops.

“Currently, the market is experiencing a shortage of stock to meet the demand. This, coupled with the prevailing low interest rates, has created the perfect sellers’ market where buyers are competing for properties, which in turn has driven prices up.

“Furthermore, the low interest rates have resulted in plenty of activity from first-time buyers, especially in the sub-R1.2 million price range. With bond repayments on R1.2 million over 30 years being under R8 000 per month, it makes more sense to buy than pay a similar amount for rent.

“Positively, the city is seeing several key developments in Gqeberha, with the R500 million Boardwalk Mall extension having commenced, which should double the amount of retail space, and a further investment of some R200 million planned for a new hotel. In the old harbour, the decommissioning and moving of fuel tanks and manganese terminals to the Port of Ngqurha will make way for the much-anticipated Waterfront development. In addition, we note general improvements with roads being resurfaced and marked again, potholes filed and the backlog on the cutting and maintenance of municipal parks being attended to,” adds Kreusch.

For further information contact Pam Golding Properties in Gqeberha (formerly Port Elizabeth) on 041 373 9955 or email justin.kreusch@pamgolding.co.za.