With inflation easing to 5.4% in June, significantly down from 6.3% in May and now comfortably within the Reserve Bank’s 3-6% target range, the Monetary Policy Committee was well justified in holding the repo rate steady at this week’s meeting, says Dr Andrew Golding, chief executive of the Pam Golding Property group.

“This is indeed encouraging news for existing and aspiring mortgage holders. Consumers, especially those with mortgages and other debt, will no doubt be breathing a collective sigh of relief at the announcement, which hopefully heralds a shift towards a stable repo rate and the start of a downward repo rate cycle in 2024. The Reserve Bank itself recently conceded that interest rates at current levels are restrictive, fortunately, however, it appears that inflation has turned a corner.

“Keeping the repo rate steady is particularly motivating for aspiring, first-time home buyers, whose appetite for home ownership remains consistent, while the banks continue to offer attractive pricing, with the first-time buyer mortgage approval rate ticking higher to 81.2% in June – according to ooba’s statistics. Coupled with this, the demand for buy-to-let investment properties continues to surge, rising to +10.9% of all ooba mortgage applications in June (2023), which is a positive indicator for the housing and rental markets. Furthermore, ooba reports that the average weighted rate of concession below prime improved marginally in June, easing to -0.42%.

“Earlier this week, prior to the MPC’s announcement, many analysts made a compelling case that the MPC had done enough to contain price pressures. Demand is weak, making it hard to pass on additional costs, and rates have already been hiked by 475bps to the highest levels in 15 years – all this at a time of subdued levels of economic activity. Considering the fact that the prime rate has risen from 7% to 11.75%, the economy and those with debt are under pressure.

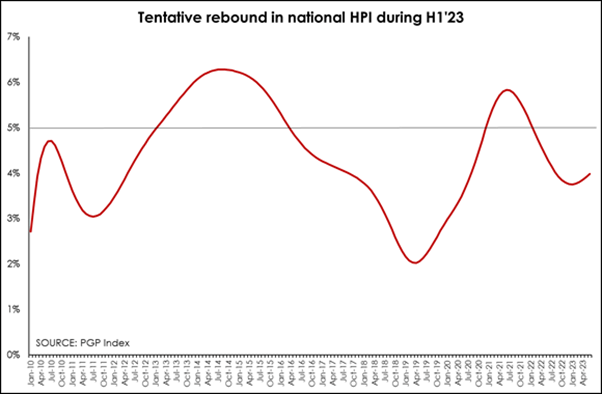

“With sentiment a key driver of the residential property market, a stable interest rate is what is needed to further boost confidence and activity. Positively for homeowners, and according to the latest Pam Golding Residential Property Index, the tentative rebound in national house price inflation continued in June 2023, rising from a cyclical low of 3.75% in January 2023 to 3.98% last month.

Source: Lightstone

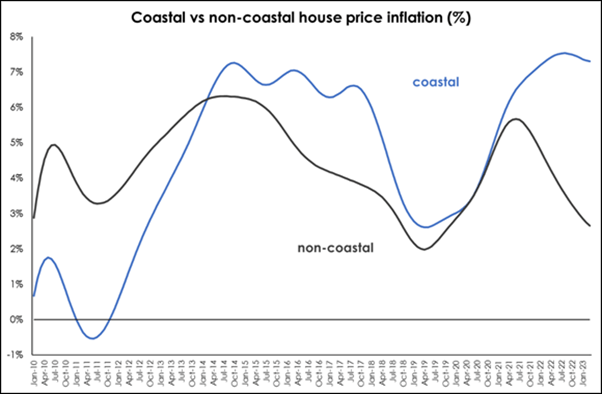

Notably, in the lower price band below R1 million, house price growth continued to gather meaningful momentum at +7.6% above year-earlier in June. Another standout statistic is the steady widening of the coastal price premium (within 5km of coastline) to +4.6% in Q1 2023. This is due to the fact that although the revised coastal house price inflation rate has clearly peaked, non-coastal HPI is losing momentum.

Source: Lightstone

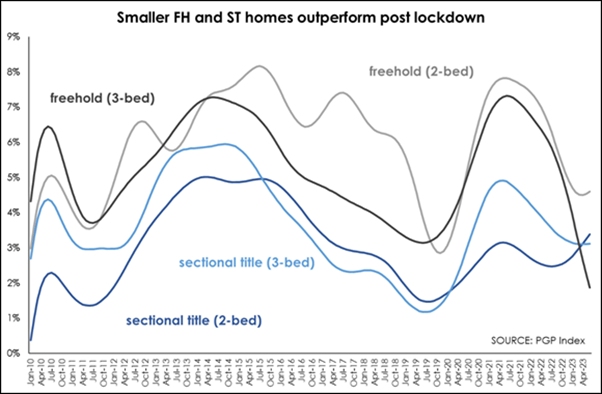

Also of interest is that sectional title HPI has gathered steam, rising to +2.9% in June and thereby exceeding freehold HPI (+2.5%in June) for the first time since late-2004.

From an investment perspective, statistics from the Pam Golding Residential Property Index reveal that smaller, two-bedroom, freehold house prices have rebounded by +4.6% in June, while smaller, two-bedroom, sectional title HPI continues to increase momentum by +3.4%. Meanwhile, larger, three-bedroom, freehold homes have seen HPI slow to 1.9%.

While we continue to experience solid activity in high-demand locations and key nodes around the country, including the major metro areas, and sought-after, luxury destinations, we are optimistic that the decision to keep the repo rate on hold will help boost activity in the residential property market in general.

For further information visit www.pamgolding.co.za or email headoffice@pamgolding.co.za