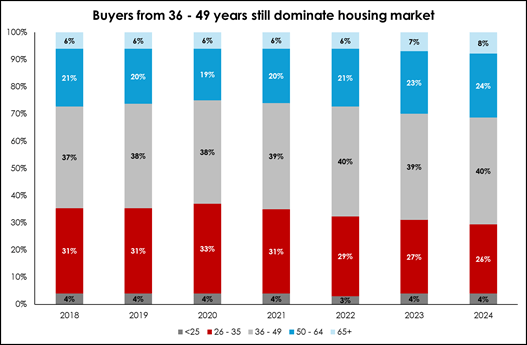

Perhaps not surprisingly, and according to Lightstone statistics, the age cohort of home buyers reflecting growth in numbers since 2018 are those between 36 and 49 years – the largest group of purchasers, while those from 50-64 are also very active buyers and investors.

Says Dr Andrew Golding, chief executive of the Pam Golding Property group: “This is logical, given that many of these purchasers have paid off their mortgages, with some also accumulating wealth in residential investments, while the younger generation from 18 to 35 years of age is generally faced with greater economic challenges and fewer financial resources, particularly first-time buyers seeking to gain a foothold in the property market.

“That said, the appetite for home ownership continues to rise among young first-time buyers. According to ooba Home Loans, the demand for mortgages from first-time buyers has again strengthened, having risen above 50% – to 51% in September 2024 – for the first time since February 2023. This is the third consecutive increase in demand from first-time buyers. With the banks remaining supportive and an improved inflation outlook, the prospect of further interest rate relief in the next 12-15 months augurs well for first-time buyer demand in the near future.

“Notably,” says Dr Golding, “the percentage of purchases by buyers aged 36-49 years has risen from 37% in 2018 to 40% during the first half of 2024. According to ooba, the average age of all buyers in South Africa currently is 39 years of age – two years higher than a decade ago. As the average age of a first-time buyer is currently 35 years (2024) this category does not include the majority of first-time buyers. The 36-49 age cohort includes young professionals and families wanting to upsize and upgrade, and relocate for various reasons, as well as investors.

“Meanwhile the percentage of sales accounted for by buyers from 26-35 years has declined, falling from 31% in 2018 to 26% during the first half of 2024 and impacted by the interest rate hikes in the wake of the pandemic, which resulted in a deterioration in affordability, compelling first-time buyers to wait longer before making their initial purchase.”

Source: Lightstone statistics:

Dr Golding says that buyers between the ages of 50-64 account for an increasing percentage of sales across the residential property market nationally, rising from 21% in 2018 to 24% during the first half of the year. This age group includes those semigrating to the Western Cape and other coastal areas as semigrants are typically older, more affluent buyers, with many looking to retire to the coast. This age group most likely includes a significant number of investment buyers, a sector which has risen in recent years amidst a marked increase in investment demand – particularly in the Western Cape.

“Retirees and those 65 years plus have seen a slight increase from 6% to 8%, probably due to downsizing due to life stage, relocating to be closer to family, or purchasing within a retirement development – particularly those which have high appeal due to lifestyle and security factors such as a large estate like Val de Vie which offers various options, including assisted living if required in the future,” says Dr Golding.

“If downsizing, this age group generally does not wish to compromise on quality, so they tend to favour new-build developments, including secure estates with ease of access to all amenities and the convenience of lock-up-and-go living, while enjoying an active lifestyle or even working from home.”

Concludes Dr Golding: “There are several reasons for the general age increase in home buyers.

“Affordability has deteriorated amidst tough economic conditions and elevated interest rates, delaying some buyers from making their first property acquisition, while others may have decided to wait longer before purchasing for lifestyle or life stage reasons. As a result, there is a general increase in the average age of homebuyers, which may well reverse in the years ahead, depending on the extent of interest rate relief in the current cycle.

“Positively, there has been a marked increase in investment demand in recent years, particularly in the Western Cape where 31.1% of applications received by ooba Home Loans for the year to date have been investment properties, and it is likely that many of these are in the upper age groups.

“Furthermore, people are remaining economically active for longer and may well opt for a lock-up-and-go home in a desirable location before ultimately purchasing a home to retire to.”

For further information visit www.pamgolding.co.za