“At the time, the higher-than-anticipated 50bps rate hike at the previous (March 2023) MPC meeting was widely thought to be the last – or at worst the penultimate – repo rate hike in the current interest rate cycle. Not only had interest rates risen beyond their pre-Covid highs of 10.25% but severe loadshedding was causing a rapid deterioration in the local economic outlook.

Unfortunately, the upside risks to the inflation outlook that the Reserve Bank highlighted at last month’s MPC materialised, compelling the Bank to hike rates by a further 50bps at the May meeting. With a number of local factors continuing to pose further upside risks to the inflation outlook, there is now less certainty that rates are now finally at a peak.

Positively on the global front, inflationary pressures are showing increasingly reassuring signs of abating, while here in South Africa, headline consumer inflation (according to the Consumer Price Index – CPI) eased to 6.8% in April – down from 7.1% in March.

Notwithstanding this, Rand weakness and loadshedding are fuelling local costs and limiting the extent to which we could potentially benefit from lower global food and energy prices.

While the Reserve Bank acknowledges that interest rates are not the ideal mechanism for containing inflation, the Bank is being forced to act alone – raising interest rates in a zero-growth economy in an attempt to prevent rising inflation expectations from becoming entrenched.

What does this mean for homeowners?

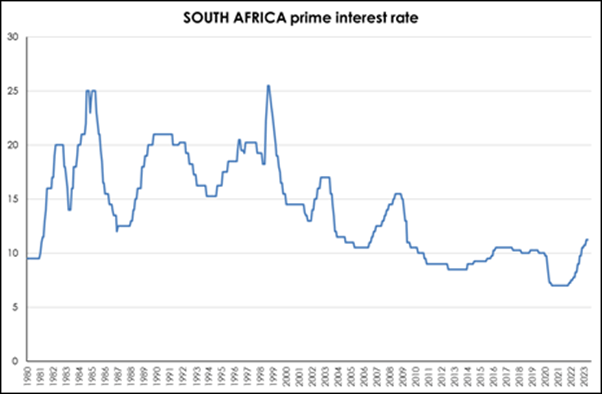

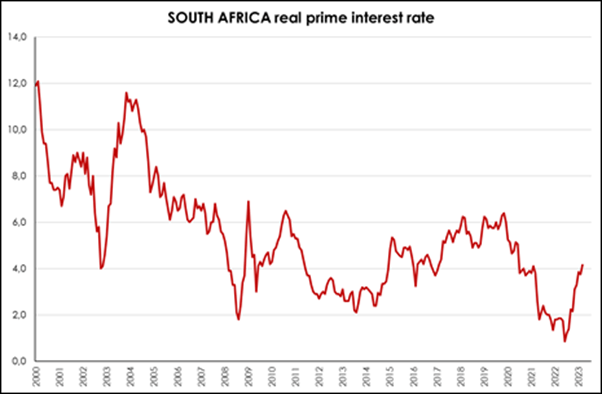

South Africa has weathered far higher interest rates in the past (see graph below), and when adjusting for inflation, the real prime rate is not as high as it was prior to the pandemic. Despite this, the higher interest rate will undoubtedly provide a challenge for the many first-time buyers who capitalised on the low rates during the pandemic in order to gain a foothold in the property market.

Against the backdrop of the current lacklustre economic outlook for South Africa, with loadshedding in particular weighing on growth prospects – especially as we head into winter- and fuelling inflation, given the considerable cost of energy alternatives such as generators and diesel used by retailers and the like, which are ultimately to be passed on the consumers, pose significant headwinds to the property market. However, people, especially young adults, require homes and many need to move to economic hubs which offer employment opportunities or a sustainable and secure life for families.

Recent Pam Golding Properties research showed that even as overall housing activity slowed, sales in major metro areas have remained buoyant, as young adults continue to be attracted to key business nodes to start careers and ultimately purchase homes.

While employment prospects ensure the enduring appeal of housing markets in all major metro nodes, lifestyle considerations continue to encourage relocation by those who are able to, to destinations, including smaller towns, where the way of life is more appealing and house prices are more affordable.

In terms of lifestyle playing a role in purchasing decisions, there is still a strong preference for coastal properties (within 5km of coastline) – as highlighted by the still widening coastal price premium, which is seeing house price inflation for coastal properties exceed that of non-coastal properties since late-2020 (latest Pam Golding Residential Property Index).

The appeal of sustainable municipalities is clear in the surge in investment/buy-to-rent demand in the Western Cape, indicating that even if homebuyers are not able to move immediately, there is a groundswell of those who wish to participate in the Western Cape housing market with a view to retire or relocate there when possible – or at least to benefit economically from the still buoyant Western Cape housing market.

At the top-end luxury sector of the residential property market, and despite the current constrained economic trading conditions, there are several niche markets in prime nodes which continue to attract affluent buyers from around the country. These include Tshwane, Johannesburg – such as Sandhurst and Hyde Park, Steyn City in Fourways, Durban – including Morningside, Westville, uMhlanga and Brighton Beach, and Ballito/Zimbali, as well as the Western Cape – including the Garden Route. Furthermore, the top-end of the Cape market has shown itself to be resilient and insulated to some degree from the rest of the market with international buyer demand in this segment featuring prominently.”

For further information contact Pam Golding Properties via headoffice@pamgolding.co.za or 021 7101700 or visit www.pamgolding.co.za