As widely forecast and generally agreed by economists and market commentators, the SA Reserve Bank again kept the repo rate unchanged at 8.25% at this week’s Monetary Policy Committee meeting.

Much will now depend on future data releases and whether they provide sufficient evidence of continued progress toward the inflation target to embark on a downward repo rate cycle. However, it has become apparent that neither the Fed nor the SARB are in any hurry to cut interest rates until such compelling evidence is available.

While expectations of rate cuts have been repeatedly downgraded and delayed, it is still anticipated that there will be some minor relief before the 2024 year-end. However, the likely timing will depend on the monitoring of future data releases for confirmation that inflation expectations are anchored around the target.

Encouragingly, the news flow since the March MPC meeting has been mostly positive. Headline CPI eased to 5.2% in April – slightly better than expected – with an encouraging easing in food and services price pressures and a marked easing in core CPI to 4.6% from 4.9% in March. News of a likely 85c per litre reduction in the petrol price in June is also positive.

Furthermore, some of the upside risks to the inflation outlook have also eased recently:

- Inflationary pressures have continued to decline in both the UK and Europe

- The Middle East conflict has not caused a spike in the oil price as initially feared, instead the concern is that US interest rates remaining higher for longer will suppress oil demand

- The end of El Niño, and hopefully the return of more normalised weather patterns, is positive for the outlook of food prices.

Our local economy appears to have improved somewhat in recent weeks as reduced loadshedding and an easing of logistic bottlenecks have helped reduce operating costs and hence price pressures.

With the election now behind us, macro-economic conditions are expected to become gradually more supportive over the next four to five months, so it is still possible that the first interest rate cut may be in September, followed by another 25bps reduction in November.

The rand has been relatively stable as the pre-election period has remained benign, the country has enjoyed over 50 days without load shedding, and higher non-oil commodity prices have all provided stable conditions, which have underpinned the rand.

Impacts on residential property market

Given the stable repo rate with a downward interest rate cycle on the horizon, we are anticipating a positive residential property market post-election, with both sellers and buyers who have been sitting on the fence moving forward and committing to property-related decisions. We have already seen increasing activity and interest during recent months in various key commercial hubs and sought-after nodes around the country across all sectors, including the high-end residential market.

According to the Pam Golding Residential Property Index, after stabilising at +3.0% in Q4 2023, national house price growth rose to +3.2% in Q1 2024 and to +3.4% in April 2024. The prospect of interest rate relief later this year, coupled with slightly stronger economic growth, suggests that the recovery in house price inflation will continue.

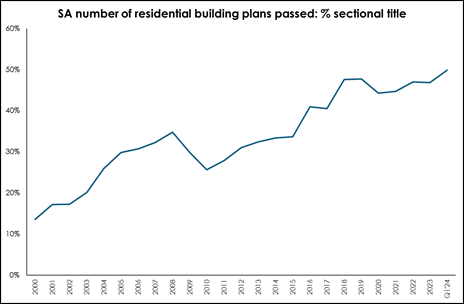

With Stats SA having recently released their March 2024 residential building plans data, it is notable that regarding building plans passed, sectional title properties accounted for nearly 50% of all planned units – up from just 13.6% in 2000 (11.4% in Q1 2000). In line with the demand for sectional title homes, the rebound in sectional title house price inflation to +2.0% in April 2024 continues to close the gap with growth in freehold prices which was +2.58% in April 2024. The graph below shows the annual average, except for the most recent point which is Q1 2024.

Source: Stats SA

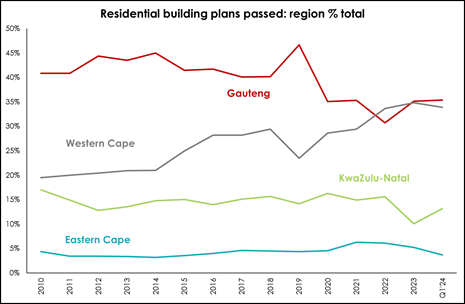

The regional graph below reveals that Gauteng once again accounts for the largest percentage of residential building plans passed after the Western Cape briefly took the top spot in 2022. Logically, Gauteng has the largest share of plans passed given that it is home to both the largest economy and the biggest population.

Source: Stats SA

For further information visit www.pamgolding.co.za.

All above comments by Dr Andrew Golding, chief executive of the Pam Golding Property group