Dr Andrew Golding, chief executive of the Pam Golding Property group, comments:

With inflation edging slightly higher to 3.6% in December 2025 from 3.5% in November, and despite the fuel price relief expected in February 2026 following a significant fuel price reduction in January, the Monetary Policy Committee adopted a cautious stance by keeping the repo rate unchanged at 6.75%.

While the decision was not what existing mortgage holders and prospective homebuyers seeking credit were hoping for, most market commentators believe that, with inflation remaining contained, there is scope for up to two 25bps repo rate cuts during 2026. The outlook for interest rates is supported by ongoing rand resilience, easing inflation expectations, and softer global oil prices.

Positively, the demand for housing remains steady, with stock shortages in high-demand areas and signs of recovery evident across markets and regions, including Gauteng. Furthermore, according to ooba Home Loans, demand for investment and buy-to-rent properties is already surging. Recent interest rate reductions, together with growing optimism around the scope for further cuts this year and improved prospects for stronger economic growth, have supported a clear rebound in investor demand.

All factors considered, the year ahead is therefore expected to offer sound prospects for both buyers and sellers. As interest rates gradually ease and filter through the housing market, affordability should improve, while competitive lending conditions are likely to sustain buyer appetite. At the same time, rising GDP and improved revenue collections underpin a stable and encouraging macroeconomic environment.

Although the luxury market is expected to continue experiencing steady demand, activity across major metros is likely to be concentrated in more affordable price bands and value-driven suburbs, as lower interest rates support increased participation by first-time buyers. Cape Town is set to remain the strongest metro overall, but sustained price growth and limited stock available for sale are likely to redirect interest toward surrounding small towns, particularly coastal and lifestyle destinations.

Pam Golding Residential Property Index statistics

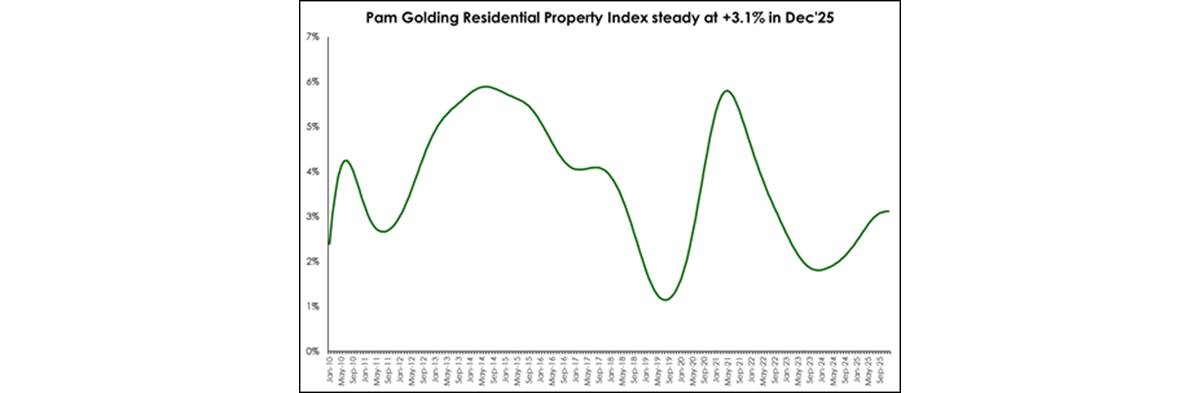

Encouragingly for home owners, according to the Pam Golding Residential Property Index, national house price inflation remained steady at +3.1% in December 2025, lifting the average to +2.9% for 2025 as a whole, which is the strongest growth in nominal house prices since 2022 (during the post-Covid housing market boom).

Revised data reveals that the R2 million-R3 million price band recorded the strongest growth in prices during the final quarter of 2025. However, house prices in the upper price band (valued at over R3 million) registered the strongest growth in prices on average over the past year of 4.5%.

|

Average HPI |

2024 |

2025 |

|

<R1m |

+0.98 % |

+1.8% |

|

R1m – R2m |

+1.7 % |

+3.2% |

|

R2m – R3m |

+2.6 % |

+4.3 % |

|

>R3m |

+4.7 % |

+4.5 % |

|

Average |

+2.0 % |

+2.9 % |

Source: Pam Golding Residential Property Index

Gauteng market gathers momentum

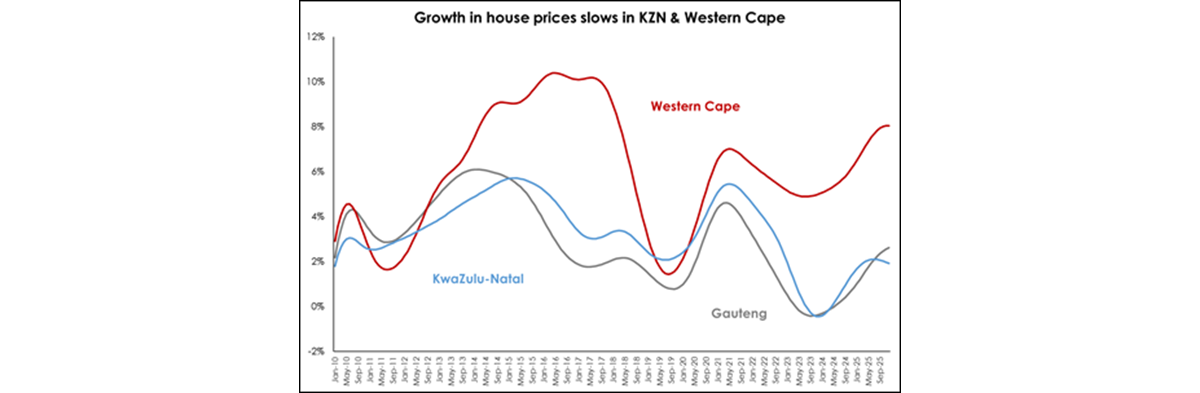

Notably, while the Western Cape continues to significantly outperform the two other major regional markets, only Gauteng, which began to outperform KwaZulu-Natal in recent months, continues to see growth in house prices gather momentum. Last year, Western Cape’s house price inflation (HPI) averaged 7.4% vs 2% in KZN and 1.9% in Gauteng.

Source: Pam Golding Residential Property Index

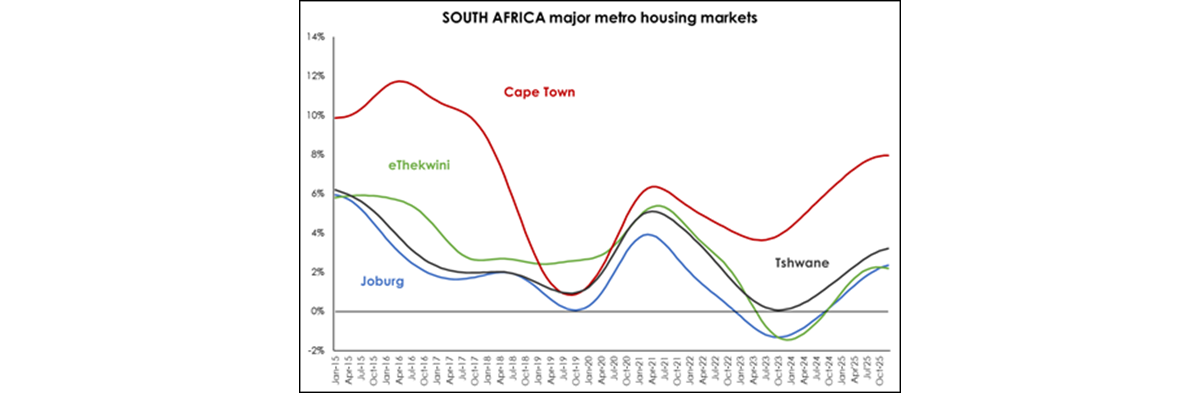

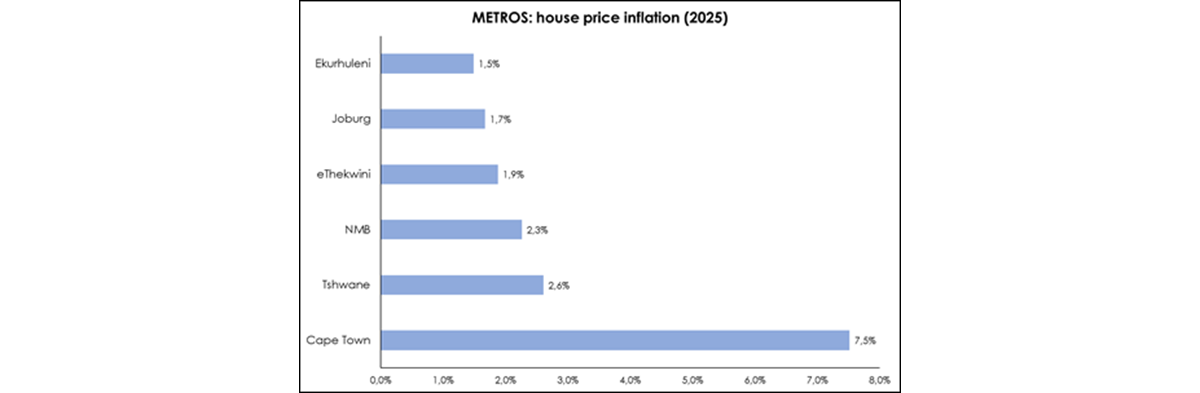

In the major metros, Cape Town continues to outperform, while Johannesburg inches ahead of eThekwini once again. Tshwane’s HPI continues to outperform both Johannesburg and Ekurhuleni.

Source: Lightstone

During 2025, Cape Town HPI outperformed other metro markets by a considerable margin – averaging +7.5% - with Tshwane trailing in second place at +2.6%. Ekurhuleni was marginally behind Johannesburg’s 1.7% at +1.5%.

Source: Lightstone

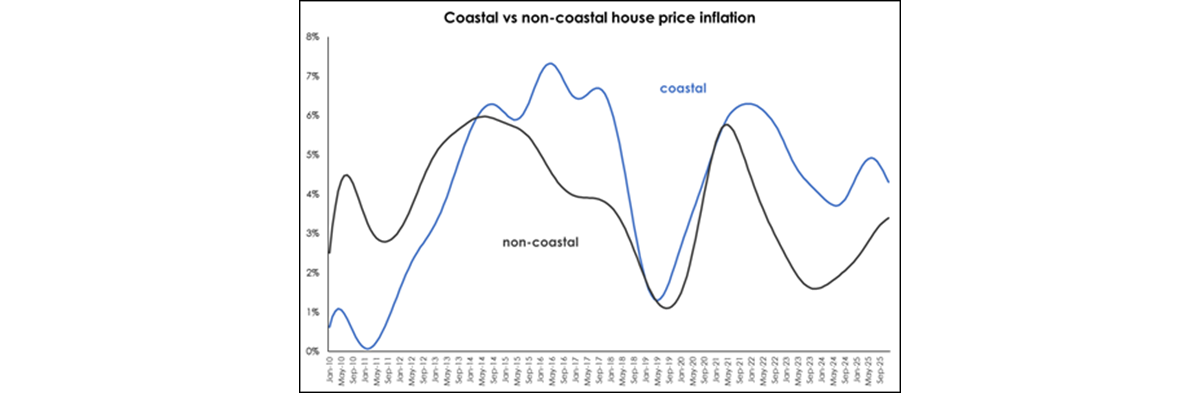

Despite losing momentum during the second half of last year, coastal HPI continues to outpace non-coastal. During 2025 as a whole, coastal HPI averaged +4.7% vs non-coastal at +2.9%.

Source: Lightstone

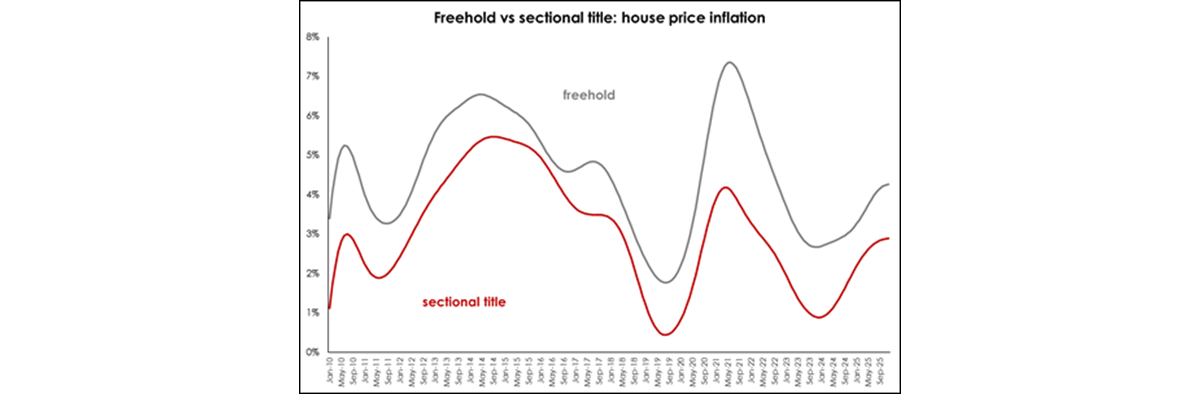

Meanwhile, freehold HPI continues to outperform growth in sectional title house prices. During 2025, freehold HPI averaged +3.9% vs 2.65% for sectional title properties.

Source: Lightstone

All comments above by Dr Andrew Golding, chief executive of the Pam Golding Property group