By Dr Andrew Golding, chief executive of the Pam Golding Property group

On the back of November’s (2025) interest rate reduction - with further cuts anticipated by mid-2026, and supported by a new 3% inflation target indicating greater price stability, increased affordability for home loan seekers and a stronger lending appetite by the banks, together with South Africa’s removal from the FATF Grey List and, notably, S&P’s first credit rating upgrade in 20 years, 2025 draws to a distinctly more buoyant close.

By lowering the inflation target to 3%, the Reserve Bank aims to anchor inflation expectations more firmly, thereby creating scope for further interest rate cuts, (possibly 75bps) according to the latest forecasts. This will reduce home loan costs, stimulate demand and enhance banks’ willingness to lend.

All these increasingly positive macro-economic indicators serve to further boost market confidence in general, with spin-offs in turn for favourable sentiment and increased activity in the housing market. For example, in certain suburbs in Johannesburg we are seeing a shortage of stock which has not been experienced for a long time.

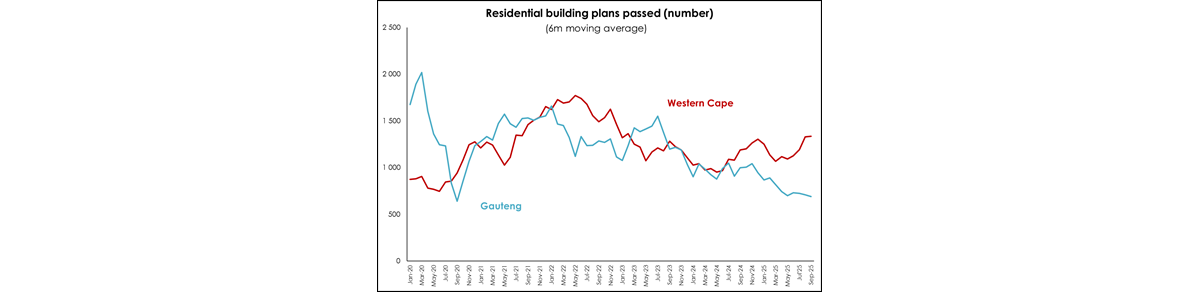

Cape Town’s continued outperformance reflects ongoing demand and an intensifying shortage of supply, despite ongoing development. Demand for residential property in Cape Town is being reinforced by ongoing, albeit slower, semigration, and brisk investment demand. According to StatsSA, the Western Cape accounts for 44.3% of building plans passed for 2025 to date, well ahead of Gauteng at 27.6%.

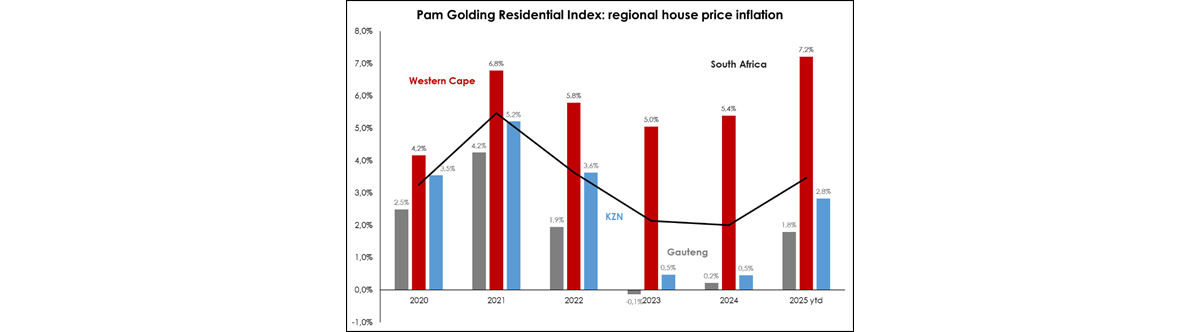

House price inflation

Encouragingly, from an investor and homeowner perspective, the national recovery in house prices is evident across all three major regional housing markets, with the Western Cape, which led the recovery, continuing to register the strongest growth in prices.

SOURCE: Pam Golding Residential Property Index

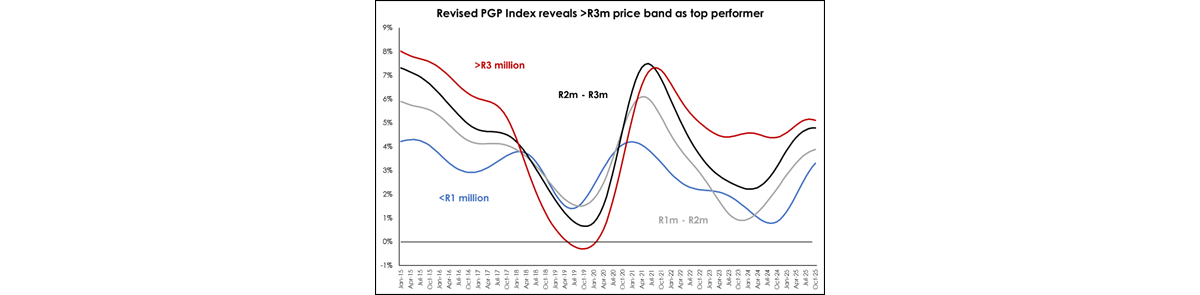

According to the Pam Golding Residential Property Index, the top price band continues to register the strongest growth in prices for the fourth consecutive year. Year-to-date, house price inflation (HPI) for >R3 million homes has averaged +4.96% (Jan-Oct’25) while the slowest growth has been recorded by homes priced below R1 million at 2.31% during the same period.

SOURCE: Pam Golding Residential Property Index

While the recovery in the revised national HPI continues to gather momentum, the uptick in the consumer inflation rate to +3.6% in Oct’25 resulted in real (inflation-adjusted) HPI easing to +0.2% in Oct’25, the eighth consecutive month in positive territory.

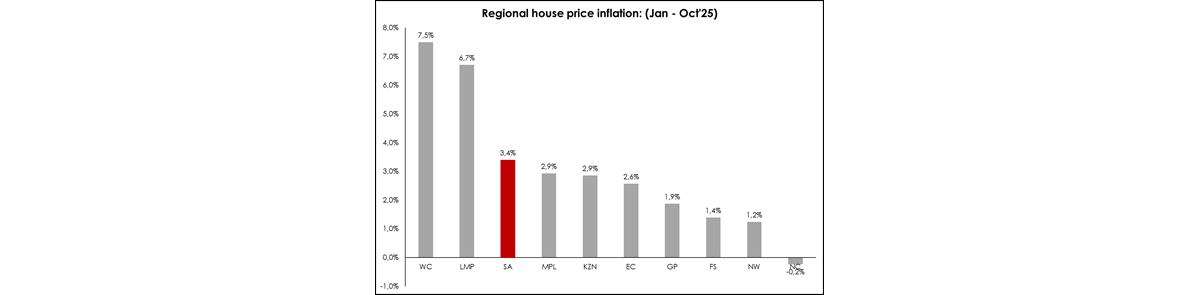

SOURCE: Lightstone

While the current recovery in the national housing market started in the Western Cape, it has become more broad-based, with all provinces now registering positive growth in house prices during the year to date (2025).

Notably, despite accounting for just 1.3% of total national sales (by value), house prices in Limpopo are soaring, and in this regard, for the year-to-date, Limpopo is second only to the Western Cape among SA’s regional markets.

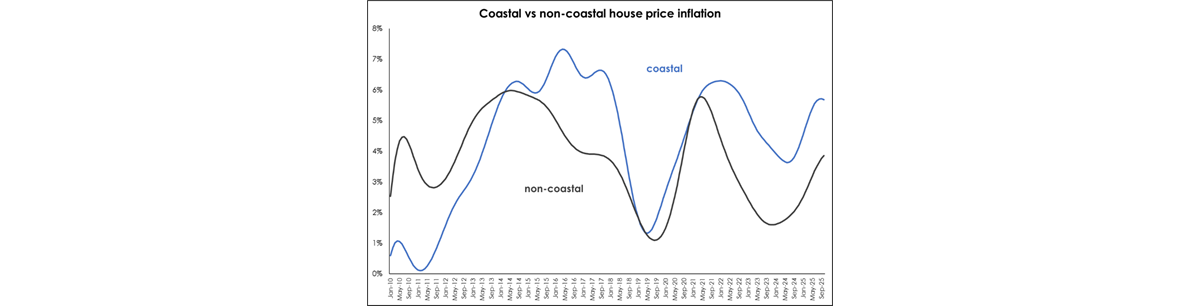

Coastal vs non-coastal HPI

The growth in coastal house prices appears to have slowed, peaking at +5.7% during the past three months. Meanwhile non-coastal HPI continues to gather momentum, rising to +3.9% in Oct’25. As a result, the coastal price premium narrowed to +1.8% last month. Lightstone defines coastal properties as those located within 500 metres of the coastline.

SOURCE: Lightstone

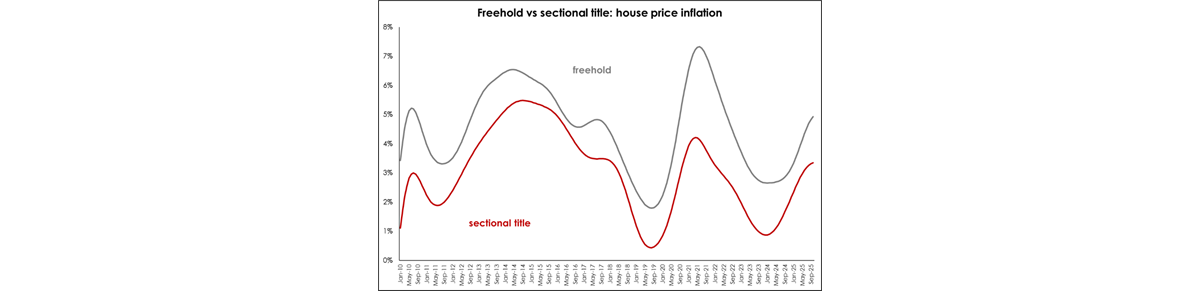

Freehold vs sectional title homes

Notwithstanding that first-time buyers continue to prefer freehold homes, the percentage of sectional title homes purchased is increasing as a percentage of total sales. A greater percentage of female first-time buyers opt for a sectional title home, possibly because it is more affordable, requires less maintenance, and is generally more secure. However, when a first-time buyer is purchasing an investment property, a sectional title home is the preferred choice.

SOURCE: Lightstone

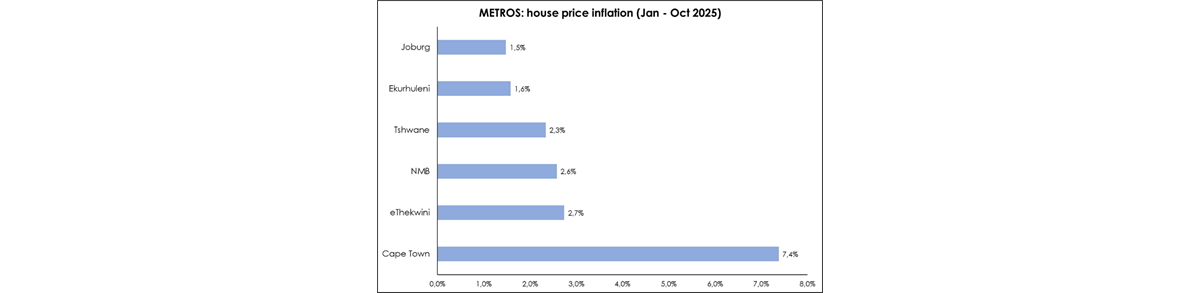

HPI in Metro markets

Among metro housing markets, Cape Town was the first to recover. While it remains the primary engine of the recovery, Tshwane is also making a solid contribution, and the recovery has now spread to all metro markets. Year-to-date, Cape Town continues to outperform other major metro housing markets in terms of HPI by a wide margin while two of Gauteng’s three metro markets – Johannesburg and Ekurhuleni - continue to lag.

Within Gauteng, house price inflation (HPI) in Tshwane continues to outperform relative to the two other metro housing markets. Prices are strengthening in all three coastal metro markets.

SOURCE: Lightstone

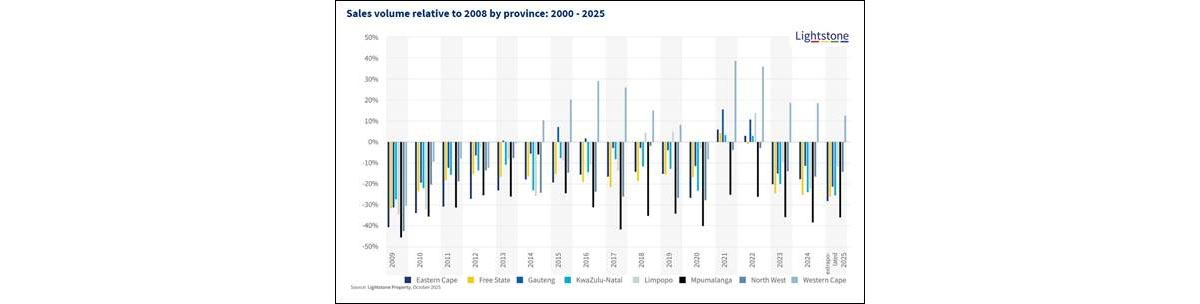

While national volumes have not fully recovered to pre-2008 levels, the Western Cape has registered a recovery in sales volumes based on a 2008 benchmark. While most positive changes are from this province, Limpopo has also shown gains. The graph below highlights the significant outperformance of the Western Cape market in terms of sales volume. While already evident that this region is outperforming in terms of price, it is also clear that the influx of semigrants is indeed significantly impacting activity too.

SOURCE: Lightstone

Luxury market

The luxury (and lower-ends) of the residential property market are likely to perform best next year (2026). In the luxury market, demand is being driven by returning expat South Africans, a reduction in emigration and the relocation of affluent buyers from the interior provinces to the coastal regions. While the latter benefits the Western Cape, Gauteng’s luxury market is benefiting from the return of international buyers, particularly from across Africa. Overall, the luxury market in SA appears to be faced with a shortage of stock, with the Western Cape and Cape Town in particular experiencing high levels of demand, especially in the City Bowl, Atlantic Seaboard and Southern Suburbs areas of Bishopscourt and Constantia, as well as Stellenbosch and Franschhoek in the Cape Winelands. This year we’ve noted that achieved property prices of R50 million and even beyond R100 million are no longer rare exceptions in the high-end sector of the market. Prices are surpassing expectations amid significant interest from a mix of local, national and international buyers.

Foreign buyers

Foreign buyers, including returning SA expats and purchasers/investors from elsewhere on the African continent, continue to show increased interest in acquiring residential property across all price bands in numerous regions. While from countries around the world, these purchasers originate mainly from the UK, Germany, Zimbabwe, USA, Netherlands, Switzerland, China, Mozambique, Congo and France.

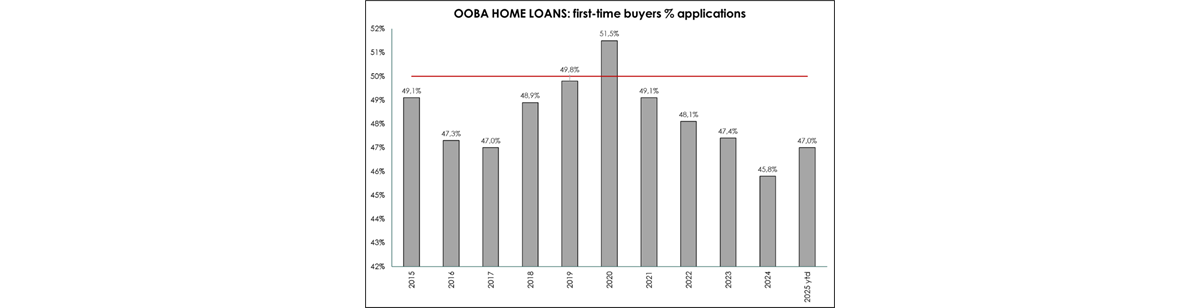

First-time buyers

Recent interest rate cuts, fuel price reductions during the year and subdued inflation continue to underpin first-time buyer (FTB) demand, which continues to strengthen, rising to 47.8% of all applications received by ooba Home Loans in Oct’25 and averaging 47% for 2025 to date.

Source: ooba Home Loans

FTB applications increased in three of the nine regions monitored by ooba Home Loans in Oct’25, with a marked increase in FTB demand evident in Johannesburg in both September and October, with FTBs accounting for 51.7% of all applications received last month. Year to date, FTB demand was strongest in the Free State (60.3% of applications) and Mpumalanga (55.8%). Growth in the average price paid by FTB in 2025 to date remains strongest in Tshwane (+12.4%) and Eastern Cape (+11.5%).

Female buyers

Over the past decade, women have emerged as dominant players in South Africa’s residential property landscape, accounting for nearly 60% of ownership either independently or jointly. Notably, female first-time buyers now outnumber males, with 53% purchasing solo in 2025 compared to 46.3% in 2015 (ooba Home Loans). This shift reflects broader socio-economic trends: women’s average gross income has grown by 76.3% over the past 10 years, enabling more independent purchases. However, female income has remained lower than male income by a fairly consistent margin over the past decade. Many are entering the market younger, prioritising security, affordability, and lifestyle integration - from gated communities and energy-efficient homes to proximity to schools and work. In regions like KwaZulu-Natal and the Eastern Cape, women lead first-time ownership gains at 57.7% and 56.2% of 2025 mortgage applications, respectively, according to ooba Home Loans.

Banks remain supportive

- The average national concession relative to prime narrowed to -0.63% in Oct’25. The Western Cape (-0.89%) and Eastern Cape (-0.76%) continued to register the most competitively priced home loans during the year to Oct’25.

- The overall approval rate has drifted higher in recent months, averaging 84.2% in the past three months. Despite a sharp increase in the approval rate for buyers without pre-qualification (80.9% 3m MA), pre-qualified applicants continue to enjoy a far higher approval rate (91.1%).

- Meanwhile, the demand for 100% and >100% loans continue to rise. Applications for 100% loans rose to 55.6% in Q3’25, above Q1’24 lows but well below the mid-2020 peak of 67.5% of total applications. Demand for >100% loans rose to an all-time high of 6.6% in Q3’25.

- The average national deposit (as % of purchase price) eased in Oct’25, declining to 14.0% from 14.3% in Sep’25. In contrast, deposits paid by first-time buyers are drifting lower once more, easing to 9.4% in Oct’25 (6m MA).

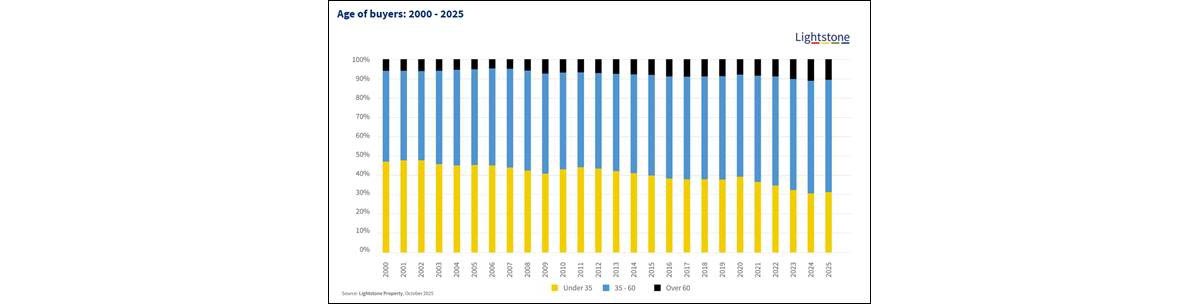

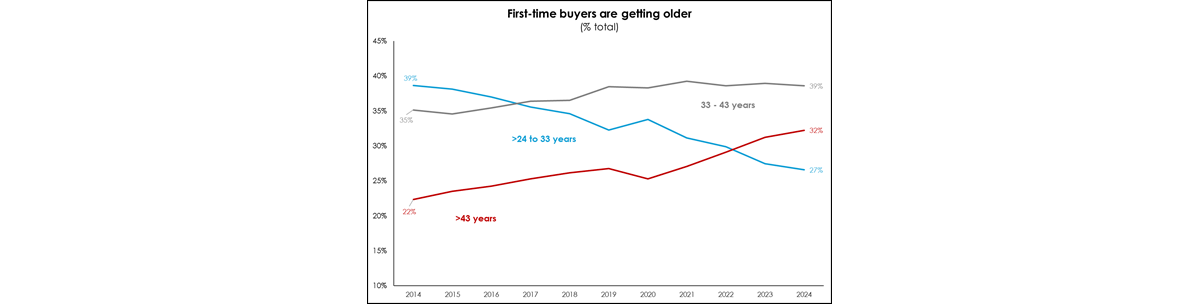

Age of buyers

South Africa is part of a global trend which is seeing people buying homes later, with the average age of first-time buyers rising. As a result, the average age of buyers of residential properties is rising.

SOURCE: Lightstone

According to Lightstone, the percentage of buyers who are over 60 years has doubled since 2000, while those under the age of 35 has declined from around 45% in 2000 to just 30% in 2025. As a result, the percentage of buyers aged between 35-60 has increased from half in 2000 to 70% in 2025.

Buyers are getting older as a result of a deterioration in affordability, as pressure on household finances squeezes the ability to save for a deposit etc. The current global environment, which is characterised by unusually elevated levels of uncertainty – which is resulting in a high degree of uncertainty in financial markets in general and interest rates in particular, is also weighing on sentiment.

SOURCE: ooba Home Loans

The ooba data above is end-2024 but highlights how the most rapid growth in age bands among FTB is the >43 year olds – reflecting the fact that challenging economic conditions are delaying the ability of many South Africans to buy their first home until later in life. According to Lightstone, in 2000, buyers under the age of 35 years accounted for 47% of transactions, however by 2024 this had fallen to 30%.

Policies such as offering assistance to first-time buyers, lower required deposits, more supply of affordable housing, and improving access to credit can help shift buying patterns, but even in markets with such strategies, ages are still rising. This trend impacts housing markets, and even more so in a country such as South Africa with an increasing and mostly young population.

Investment buyers

According to ooba Home Loans, the d emand for investment / buy-to-rent properties ticked higher in Oct’25, rising to 13.2% of all applications Investment demand remains elevated in the Western Cape, at 35.8% of applications in Oct’25 and remained steady at 13% in Tshwane.

Building plans passed

There has been a recovery in the number of residential building plans passed in SA since early-2025. This is primarily being led by the Western Cape, which is seeing a marked increase in the number of planned flats and townhouses. This trend also reflects the increase in mixed-used developments due to issues of affordability, limited land in business nodes becoming more expensive, security, and lifestyle preferences such as lock-up-and-go’s.

SOURCE: Statistics South Africa

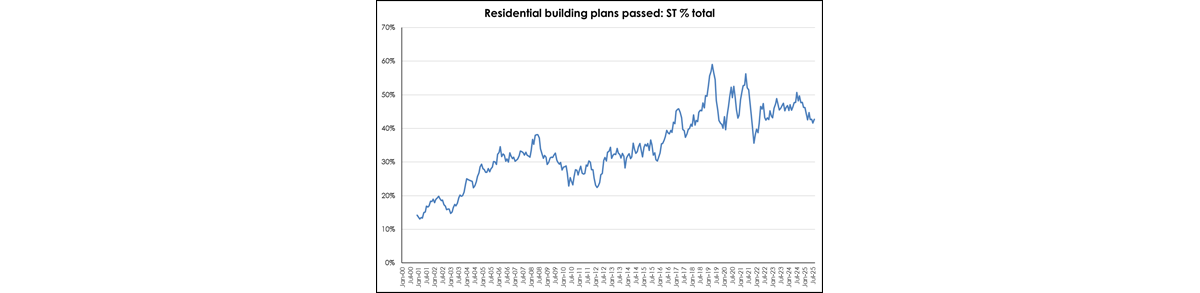

Shift in building plans passed to sectional title homes

A young urbanising population, coupled with a shortage of vacant land, growing congestion and rising building costs and changing lifestyles, is seeing a steady shift in building plans passed towards sectional title homes. In cities like Cape Town and Tshwane, where well-located land is at a premium, smaller homes, mostly in mixed-use developments, are increasingly popular. Not only does the smaller size make the homes more affordable but it also suits changing lifestyles which favour lock-up-and-go apartments, while the development they are located in (either a mixed-use development or estate) offers access to amenities which the homeowner may not have been able to afford on their own (such as a gym, swimming pool), or is not inclined to maintain (cost and time), while offering superior security. Furthermore, because of the mixed-use development and the location (often in a business node), owners may be able to walk or take a short drive to amenities.

The percentage of residential building plans passed which are for sectional title homes has risen from just 13.6% in 2000 to a peak of 48.1% in 2020 to 42.9% in 2025 (Jan – Aug’25). The decline in the post-Covid years is presumably due, in part, to the shift to smaller towns and villages or peripheral suburbs during the switch to work from home, as well as semigration. As people move out of the urban nodes, they are able to afford freehold homes.

SOURCE: Statistics South Africa

Growth areas

Areas like the Garden Route continue to benefit from the semigration to the Western Cape and the shift in those relocating to the province from Cape Town to smaller towns and villages. In addition to the Garden Route, other areas which are benefitting are Western Cape’s Stellenbosch, Paarl and Franschhoek, and towns along the Whale Coast.

KEY TRENDS

Semigration: Semigration is evolving in 2025, with a continued, though slightly slowed, flow of people to the Western Cape, while a "reverse semigration" trend sees a return of individuals to Gauteng, primarily driven by job opportunities and the rising cost of living in coastal areas.

Western Cape remains a magnet, but pace slows: The Western Cape continues to attract more people than it loses, driven by lifestyle security, better governance, and quality of life. However, the pace of inward migration has slowed compared to previous years due to soaring property prices, increased congestion, and challenges like long school waiting lists in Cape Town and its immediate suburbs.

In Q4, the pace at which perceptions of value have shifted in the Cape Metro has been so rapid that it’s become challenging to pinpoint the exact fundamentals driving the seemingly limitless demand for property. While record-breaking prices and surging appetite at the very top end have dominated headlines, the same dynamic is playing out across all market segments in the Cape Metro and surrounding areas. Although stock shortages, driven by a lack of homes coming onto the market, remain a concern, the underlying fundamentals are robust. As demand continues to outstrip supply, prices are expected to maintain their strong upward trajectory, which may result in more stock being released.

Across the Boland and Overberg regions of the Western Cape, demand for homes remains strong, although stock shortages persist. Properties priced below R4 million are particularly sought after, and when a well-maintained home, or even one in a desirable area requiring some TLC, enters the market, it often attracts multiple competing offers. In some cases, properties are selling for above the asking price. Properties within estates like Val de Vie and Boschenmeer near Paarl and Fernkloof in Hermanus, are sought after due to the lifestyle and security offered. In the Newinbosch development in Stellenbosch, 80 of the 130 units sold within two days in one of the recent phases launched.

Because of the diversity of the Boland and Overberg regions they attract a range of buyers from young families looking for areas with good schools, like Durbanville, Paarl and Stellenbosch, to retirees or second home buyers seeking coastal homes in areas along the Whale Coast. Country towns offering good value for money have also seen an increase in demand such as Elgin just 20 minutes from Somerset West, where you can buy a beautiful three-bedroom home on 900 sqm, surrounded by orchards for R3.3 million. This region has had one of its best years and although most buyers are still locals wanting to upscale or downscale, or upcountry buyers looking to semigrate, the sales and enquiries from foreign buyers and expats are consistent. Franschhoek remains a popular choice among foreign buyers.

Gauteng's comeback (reverse semigration): There is some evidence of a counter-trend of "reverse semigration" to Gauteng. The province is experiencing the strongest overall population growth and a resurgence in housing demand due to its status as the country's economic engine and primary job market. If next year’s local elections result in a market-friendly shift in government, this could have a major positive impact on Gauteng’s housing markets as it would not only reduce the outflow of older, more affluent homeowners but could reinforce the reverse semigration trend.

We have certainly started to notice a gradual uptick in demand and activity across the Johannesburg Metro region, particularly since the recent rate cuts. The greatest movement has been in the R1 million to R3 million price segment, supported by more accessible lending conditions and the banks’ continued competitiveness. While financial pressure remains a key selling factor in Gauteng, it has eased slightly over the past year, and we are seeing more upgrading activity and first-time buyers returning, especially younger professionals taking advantage of cost-inclusive loans and favourable bank approval rates. Confidence is certainly improving, albeit cautiously, and sentiment towards property as a stable long-term investment remains strong.

There is also a notable rise in lifestyle and security-driven sales, reflecting shifting priorities among urban buyers. Many are opting for smaller, low-maintenance homes within secure estates or well-located nodes that offer convenience and community living. Despite ongoing affordability constraints, market activity in Gauteng is showing healthy resilience, with renewed buyer interest suggesting that 2026 may bring a steadier period of growth for the region.

KZN North Coast sets new benchmark for land values: The KwaZulu-Natal North Coast continues to experience ongoing demand, with great anticipation around the Club Med Tinley development set to open mid-2026, resulting in what is colloquially known as the ‘Club Med’ knock-on effect, resulting in increased interest in local upmarket residential estates like Zimbali, Simbithi and Seaton. We are experiencing an uptick in interest in the R10 million plus category, with buyers prioritising lifestyle, and some reverse semigration from Cape Town to KZN. In the areas just north of Durban, including Durban North, uMhlanga and Sibaya, an upturn in positive sentiment is starting to create some stock shortages, so anything well-priced sells quickly, including the upper end of the market. Activity in residential estates such as Hawaan Forest, Signature and Gold Coast estates is brisk, while the recent R634 million in sales within just two days of launching Beachwood Coastal Estate on Durban North’s beachfront set a new benchmark for land values in the province, achieving over R10 000 per square metre and attracting mainly local buyers as well as purchasers and investors from upcountry, Dubai and Tokyo, with villas selling for up to R25 million, apartments around R15 million, and vacant erven reaching R20 million for 1 700sqm.

Rise of the Eastern Cape and smaller coastal towns: As the Western Cape becomes less affordable, prospective buyers are looking for similar lifestyles in other regions. The Eastern Cape, particularly Gqeberha and other areas, has emerged as a new semigration hotspot, offering larger properties at lower prices. Smaller, relatively more affordable coastal towns like George and Knysna are also seeing a sharp upward trajectory in popularity (confirmed by building statistics which have seen sharp increases in plans passed for these smaller towns in recent years).

Return-to-Office mandates: The decline in fully remote work positions and formalised return-to-office mandates from major employers (like Vodacom and Nedbank) are drawing people back to the economic hubs of Johannesburg and Pretoria.

Reasons for selling: (Source: FNB Estate Agent Survey Q3’25):

- Life-stage downscaling remains the biggest reason for selling (26%).

- Financial pressure is still significant, driving one in five sales. However, this is lower than the 26% recorded in Q4’24 – which was the highest percentage since the global financial crisis.

- Upgraders now account for 13% of transactions, showing early signs of renewed confidence.

- Emigration sales remain low at 5%, well below the long-term average of 8%.

International markets

As the EU makes the acquisition of residency and citizenship more difficult with a number of programme closures and changes, the likes of Dubai and Mauritius have become more prominent as viable second residency options that are underpinned by a real-estate component. Mauritius continues to see South Africans and Europeans moving to the island to enjoy the sunny lifestyle, good year-round climate and favourable tax regime. Likewise, Dubai continues to entice a younger workforce looking for exciting work opportunities, families looking for a safe environment, and new businesses into its booming economy. In this regard, we are delighted that the latest addition to our growing international footprint is the official opening of our Pam Golding Properties Dubai office in January 2026. In partnership with award-winning wealth firm SVN Capital, and situated overlooking the famous Palms district, we expect the Dubai market to continue on its growth path.

That said, the Greek Golden Visa remains one of the last options for those wanting to secure EU Residency for their families. Greece itself has recently increased the investment threshold to qualify for residency to €800 000 in Athens and most of the Islands. However, one notable exception is the conversion of commercial buildings to residential developments and this has allowed us to offer what we believe may be the last credible opportunities to gain EU Residency - without having to live in Greece.

These are:

Keranis Residences, a conversion of an iconic old building in Piraeus, approximately 20 minutes from the city centre of Athens and with direct access to the historic port. Keranis is a mixed-use development consisting of 408 residential apartments, several retails shops and restaurants and leisure facilities. Entry level prices start at the minimum level of Golden Visa qualification of €250 000. The developer offers a rental fix of 3% per annum for a 10-year period. The developers are the Mercan Group with whom we have worked extensively in both Portugal and Greece. Well-established, they have already completed and are trading 14 hotels in Portugal. Greek Residency is offered to the main investor and his/her spouse and minor dependent children. Residency allows the investor and his/her family to legally reside in Greece and travel freely, without the need to acquire a visa, throughout Schengen Europe.

Kastella Bay is also located in Piraeus and within walking distance of Mikro Limo marina, offering waterside shopping and dining. It comprises only 32 units from one bedrooms starting at €250 000 to a penthouse at €1m. The penthouse could serve as an investment for four different families, contributing €250 000 each. The development is also less than 20 minutes from the centre of Athens. All units are fully furnished and investors can elect to take up a 3% guaranteed rental yield from the developer. With over 50% of the units already spoken for, potential investors are advised to act quickly.

Outlook for 2026

The positive effects of a series of interest rate cuts, still subdued price pressures and significant fuel price reductions during the course of 2025 on household finances have already boosted activity and growth in prices in the national housing market.

While it is particularly difficult to forecast with any accuracy at the moment, it seems likely that the pace of local economic activity will strengthen somewhat next year and that there may well be further interest rate relief during the first half of 2026.

If the international oil price remains subdued and the rand remains resilient, local price pressures should subside further, providing an additional boost to local household finances and in turn, the housing market.

News that SA has been removed from the Financial Action Task Force (FATF) grey list in Oct’25 has boosted investor sentiment, particularly among foreign buyers. The delisting is expected to streamline property transactions while reducing compliance costs and looks set to catalyse renewed interest in high-end real estate.

Overall, while the market is stabilising and showing pockets of vibrancy, a sustained recovery will depend on broader economic improvements, policy certainty and continued financial sector support. The local elections next year (2026) could go some way towards boosting consumer confidence, particularly in Gauteng, which has seen its housing market come under pressure due to the ongoing failure of service delivery. This is also true for most of the other housing markets in SA outside the Western Cape.

2026 looks like it will continue to offer good prospects in the property market, as interest rates continue to decline, SA’s GDP and revenue collections continue to increase, which all taken together provide for a stable and encouraging outlook for 2026.

All comments above by Dr Andrew Golding, chief executive of the Pam Golding Property group

For further information visit www.pamgolding.co.za