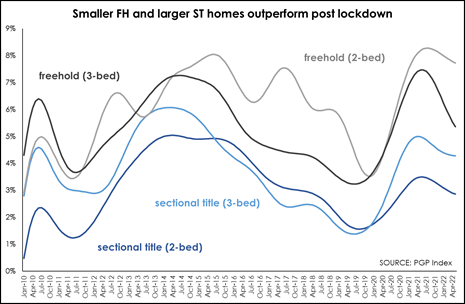

One of the key shifts in the housing market triggered by the pandemic, was that many home buyers opted for a freehold home rather than a sectional title home in order to gain access to some outdoor space, as well as additional space in order to accommodate working from home.

Says Dr Andrew Golding, chief executive of the Pam Golding Property group: “The well documented shift to peripheral suburbs and holiday/retirement towns also meant that homes were more affordable – again allowing buyers to purchase a freehold home rather than sectional title. While this led to a marked increase in growth in prices of freehold relative to sectional title residences, it has also seen smaller freehold homes showing greater resilience as the pandemic-induced freehold boom fades.

“Similarly, for those who could not afford freehold homes or who preferred the lockup and go lifestyle offered by a sectional title home, the desire for more space – particularly for those working from home – was reflected in stronger price growth in larger (three-bedroom) sectional title property prices.”

However, according to the latest Pam Golding Residential Property Index (June 2022), of all four categories (see below), it is the smaller freehold home which is enjoying the strongest price growth and is showing the greatest price resilience as the housing market cools.

| Property type | Average Jan – May 2022 (%) |

| Freehold 2-bed | +7.85 |

| Freehold 3-bed | +5.77 |

| Sectional title 2-bed | +2.96 |

| Sectional title 3-bed | +4.33 |

SOURCE: PGP Index

Says Dr Golding: “This could be attributable to a number of factors, including: a strong demand among younger buyers such as couples starting out seeking to own their own home with outdoor space (and hence freehold) to start a family; greater affordability and value for money when buying in zoom towns; and perhaps in response to rising maintenance costs and economic pressures, which could see people across generations preferring freehold – but smaller freehold, in order to contain costs.”

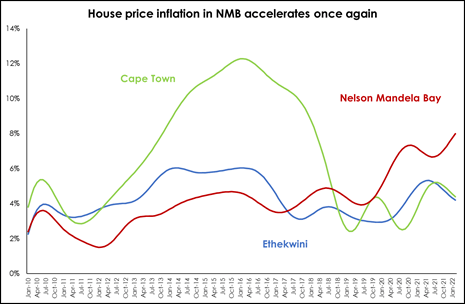

Also according to the Pam Golding Residential Property Index, while all major regional housing markets in South Africa are experiencing a gradual slowdown in house price inflation, the Western Cape continues to record the strongest growth in prices. During the first five months of the year (Jan-May 2022), house prices have risen by 4.85% nationally, but have increased by 6.5% in the Western Cape.

Positive house price growth for KZN

Somewhat surprisingly, given the challenges of repeated flooding and the impact of last year’s unrest, KwaZulu-Natal is experiencing the second highest growth in prices among the major regional housing markets – rising by 5.35% for the year (2022) to date. This is followed by Gauteng at +4.08%.

And while house price inflation in the major metro housing markets is slowing in tandem, Nelson Mandela Bay is experiencing accelerating growth in prices, outperforming relative to other coastal metro housing markets.

SOURCE: Lightstone

Interestingly, according to the Q1 2022 FNB Estate Agent Survey, while the national average time a property remains on the market prior to sale was eight weeks – unchanged from the final quarter of 2021, there are, however, significant regional variations. These range from just six weeks and three days in the Western Cape closely followed by KZN at six weeks and four days, to eight weeks and six days in Gauteng. Once again – despite the disruption in KZN over the past year – its market is showing surprising resilience both in terms of growth in house prices and in the ease of selling homes in terms of time on the market.

Adds Dr Golding: “While there may be headwinds facing the housing market – such as rising inflation, modestly increasing interest rates and a sluggish economy – an ongoing positive underpinning for the market is the appetite of financial institutions to extend credit. Not only are they pricing home loans competitively, they are also requiring lower deposits as a percentage of selling prices than we’ve seen in over a decade.”

According to ooba, the loan-to-value ratio has risen to just over 93% for three consecutive months, which is the highest level reached since their record began in May 2007. FNB estimates the market-wide loan to price ratio, derived from Deeds data, at 94.9% in the first quarter – the highest level in about 14 years.

For further information contact Pam Golding Properties on 021 7101700, headoffice@pamgolding.co.za or visit www.pamgolding.co.za